Many players like Insurance are scrambling to figure out how Blockchain could be used to improve the way they keep records, execute transactions, and interact with stakeholders.

And that’s the reason, insurance agencies are looking to embrace blockchain development services to bring automation to the industry.

The big question is whether Blockchain's unique properties can help insurers save money, manage risk, improve customer service, expand their business, and, eventually, boost profits.

When it comes to blockchain, health and life insurers should take risks. The most promising options may go beyond incremental improvements in current business models to leveraging blockchain's unique characteristics to develop totally new types of interactive policies and launch creative services that add value and expand the company.

If you want to automate crucial aspects in the insurance sector, blockchain may lend a helping hand.

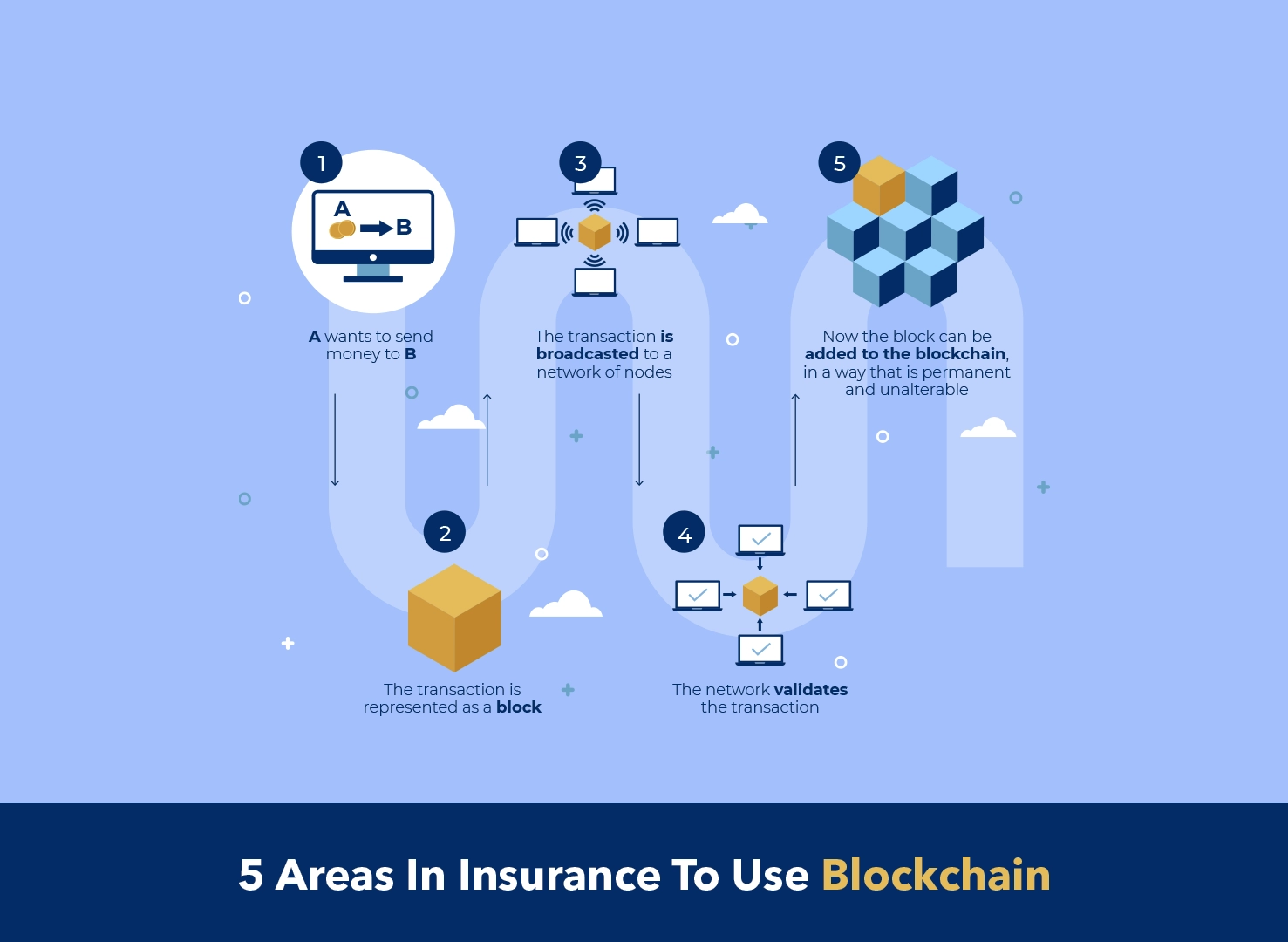

In this post, we’ll be discussing the 5 insurance areas where you must adopt Blockchain.

- Fraud & Risk Prevention

The insurance business takes advantage of Blockchain's capabilities by using it to streamline and automate the onboarding process for new customers. More particular, blockchain enables the authentication of a new customer's numerous identity documents.

Don’t know how to do it? If so, simply choose the best blockchain development company that may help prevent fraud and risk.

It then grants specialized access privileges to those who are involved in the process, effectively replacing centralized databases for data and document management. This makes the client's KYC (know your customer) and due diligence procedures easier and faster, while the insurer's procedures become more reliable and easier.

When bogus claims, falsified applications, or other channels are used to submit fraudulent information to a life or health insurance, smart contracts can help assess if the submission is real.

- Reinsurance

Reinsurers can obtain verified real-time data straight from the primary source, without having to involve their counterparties — in this case, insurers — by processing and storing data on a distributed ledger.

This also ensures that funding is allocated more quickly for future claims. The benefits become further evident when we consider that insuring corporations involves a large number of reinsurers for the same contract, which unavoidably necessitates the reinsurers exchanging data readings, further complicating operations.

- Peer-to-Peer Insurance

Insurance companies create smart contracts that automate damage reimbursement applications if inclement weather damages properties, for example.

Sensor data and weather readings are used in such contracts, making assertions more trustworthy and less subjective or potentially false.

Not only that, but insurers employ blockchain development services to organize peer-to-peer insurance marketplaces. Policyholders with this sort of insurance are entitled to higher premiums for the service than those with regular insurance contracts.

- Claim Management

Maintaining a competitive advantage requires ensuring that submitting and processing claims is as user-friendly and efficient as feasible. To limit the frequency of false claims, blockchain can be used to combine several data points from multiple sources (e.g., location, analytics).

Many streams of information and documents, such as scene evidence, third-party reports, police comments, and so on, are centralized in a distributed blockchain ledger.

You can even choose a dedicated blockchain development company to provide an easier-to-access, more comprehensive collection of medical records that could bring comfort and peace of mind to what has become an intrusive and often disappointing application process for many.

- Advanced Automation

Because there are millions of insurers, healthcare providers, and patients in the insurance ecosystem, it's easy for the sector to become mired down by inefficiencies that waste money and time due to billions of forms, human error, and poor communication between parties.

Because all forms and data are safely saved along the chain, blockchain development services can assist automate outmoded processes, save billions of hours of paperwork each year, and decrease human error.

The Bottom Line

As blockchain develops traction in the business and adoption rates rise, it is incredibly important for industry stakeholders to keep an eye on the technology's advances. Also, it is one of the best technologies which helps transaction easy in every mode.